The Electric Revolution in Off-Highway Vehicles: A Technical Deep Dive

The off-highway vehicle sector, encompassing construction, mining, agriculture, and military applications, is undergoing a profound and rapid transformation towards electrification. This paradigm shift is propelled by a confluence of stringent environmental regulations, compelling total cost of ownership (TCO) advantages, and significant technological maturation in battery systems, electric motors, and powertrain control units. Here we provide a comprehensive technical analysis of the key developments in electric motors and drive control systems, examines the burgeoning high-voltage architecture trend, and contrasts the strategic approaches of key global markets, particularly the UK and China.

1. The Global Market Landscape

The global market for electrified off-highway vehicles (OHV) is experiencing unprecedented expansion. Projections show the market growing from approximately £8.1 billion in 2023 to over £35.4 billion by 2030, reflecting a compound annual growth rate (CAGR) of around 23.6%. In terms of unit sales, the market is forecast to surge from nearly 60,000 units in 2023 to over 376,000 by 2035, a CAGR of 16.5%. This growth is fundamentally driven by tightening emissions standards, rising fuel costs, and the operational benefits of electric equipment, which include lower maintenance and “fuel” costs, reduced noise, and government initiatives and policy.

While the push for decarbonisation is global, regional strategies and market dynamics exhibit significant divergence, with the UK and China providing a stark contrast.

United Kingdom: A Focus on Hydrogen and Niche BEV Adoption The UK’s approach is characterised by a diversified technology strategy with a strong emphasis on hydrogen and a growing market for compact battery-electric vehicles (BEVs). The UK off-highway electric vehicle market is projected to grow from £121.3 million in 2023 to £321.5 million by 2030, driven by urban regeneration projects and net-zero commitments.

- OEM Strategy: Leading UK-based OEM JCB is investing over £100 million in hydrogen internal combustion engines (H2 ICEs), testing prototypes in backhoes and Loadall telehandlers. This focus is supported by legislative changes, such as the April 2025 law permitting hydrogen-powered diggers on public roads. Perkins, a Caterpillar subsidiary, is also developing hydrogen-hybrid integrated power systems with UK government funding.

- Market Dynamics: The primary driver of the e-OHV market in the United Kingdom is the government's focus on reducing carbon emissions and promoting sustainable practices. The country has set ambitious climate targets, which is creating a demand for low emission equipment in the construction and mining sectors. The increasing focus on green construction and the development of sustainable infrastructure is also a major driver, as electric off-highway vehicles offer a cleaner and more efficient solution. The demand is particularly strong for compact electric machines like JCB’s 19C-1E excavator, which are ideal for urban projects governed by Ultra Low Emission Zones (ULEZ).

- Battery Technology: The UK and European markets generally prefer Nickel Manganese Cobalt (NMC) batteries for their high energy density and power output, which is advantageous for performance-focused applications, especially in colder climates.

China: Dominance Through State Driven BEV Deployment China is aggressively leading the global off-highway electrification movement, leveraging its vast domestic manufacturing base and strong government support. The nation holds a 46% share of the Asia-Pacific off-road EV market and its electric excavator market alone is projected to reach £2.76 billion by 2033.

- OEM Strategy: Major Chinese OEMs like SANY, XCMG, Zoomlion, and LiuGong are rapidly launching new-energy machines. SANY introduced over 40 electric models in 2023, achieving £355 million in electric-equipment sales. XCMG is rolling out hydrogen fuel-cell trucks and electric loaders, with ambitious plans for a 240 tonne hydrogen mining excavator.

- Market Drivers: The primary driver of the e-OHV market in China is the strong government support for electric vehicle adoption. Growth is fuelled by ambitious policies like the “dual carbon” plan and the 14th Five-Year Plan’s electrification targets, alongside massive infrastructure investments. The country's rapid urbanisation and the resulting demand for sustainable construction and mining equipment have also played a crucial role in driving market growth . Furthermore, the presence of a robust battery manufacturing ecosystem in China has made it easier for OEMs to source high-quality batteries at competitive prices, which has helped to reduce the overall cost of electric OHV . The increasing focus on reducing air pollution in urban areas has also led to a growing demand for low emission equipment, which electric vehicles can provide.

- Battery Technology: China predominantly utilises Lithium Iron Phosphate (LFP) batteries, favoured for their lower cost, longer cycle life, and high safety profile, supported by a mature domestic supply chain and a 60% cost reduction since 2020.

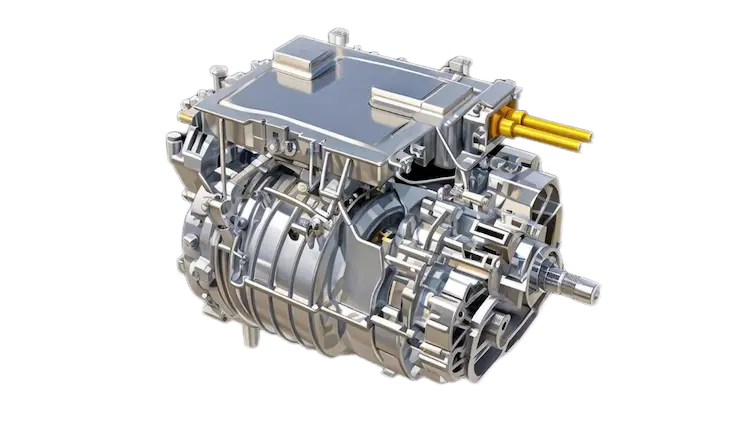

2. Core Powertrain Technologies: Motors and Integrated Drivetrains

The performance of electrified OHV hinges on rugged, high-power motors and increasingly integrated drivetrain systems designed for harsh environments.

Electric Motor Technologies Off-highway EVs primarily employ water/oil -cooled Permanent-Magnet Synchronous Motors (PMSMs) or induction motors, valued for their efficiency and power density.

- Performance Specifications: Suppliers offer a wide range of solutions, e.g., Bosch’s off-highway drives provide up to 120 kW continuous power (140 kW peak) at 400V with approximately 350 Nm of torque. For heavy duty applications, Danfoss’s Editron system covers a power range from 30 kW to 1000 kW. PMSMs typically offer power in the 200 – 500 kW range with over 95% efficiency.

- Motor Innovations: To boost torque density, technologies like axial flux motors are being adopted for compact equipment, with Daimler acquiring YASA and Renault partnering with WHYLOT. Switched Reluctance Motors (SRMs), adopted by companies like Kreisel Electric, offer fault tolerance and reduce dependency on rare-earth materials. ZF’s hair-pin winding motors achieve high torque density (45 Nm/kg), ideal for excavators.

Integrated Drivetrains and the Supplier Landscape The industry is moving towards integrated powertrain solutions that combine the motor, inverter, and transmission into a single, compact unit to reduce cabling, size, and weight while improving efficiency. This has cultivated a competitive supplier landscape. Companies like Dana, Danfoss, ZF Friedrichshafen, BorgWarner, and Bosch Rexroth are big players in the integrated drivetrain supply chains.

3. The Rising Dominance of High-Voltage (>700V) Architectures

While 400 - 600V systems are currently common, a definitive trend towards high-voltage architectures (750V and above) is emerging for heavy-duty applications. Moving to 800 - 1200V DC bus voltages allows OEMs to halve the current for the same power, which in turn shrinks cables, reduces resistive losses, and enables more compact power electronics. Although commercial deployment is still nascent, significant advancements are paving the way for imminent adoption.

Pioneering High-Voltage Products and OEMs Several global OEMs and suppliers are at the forefront of this transition. For example,

- Sandvik: Its TH550B Battery-Electric Truck features a proprietary LiFePO₄ high-voltage architecture with a system voltage implicitly greater than 700V, delivering up to 540 kW of continuous traction power. The TH665B trolley-assist haul truck also implicitly uses a ~750-800V DC system.

- Liebherr: Is actively testing an 800V architecture with 1.2 MW peak power for its T 236 Mining Truck, targeting a 2026 launch. The company is collaborating with Fortescue Metals to deploy 800V autonomous fleets in Australian iron ore mines by 2027.

- Komatsu: Its prototype mining equipment utilises American Battery Solutions (ABS) T350-50 high-voltage Li-ion packs with a 700V nominal voltage, which are scalable to higher voltages.

- Caterpillar: The new Cat 775 off-highway truck is designed with modular electronics that support voltage scalability up to 800V for future battery-electric variants.

Chinese Leadership in High-Voltage Systems Chinese companies are leading the charge in developing and deploying >700V systems, with many projects already in advanced prototyping or early commercialisation. For example,

- SANY Group: Is developing an 800V High-Voltage Platform for its “Force Harvester” heavy-truck platform, with small-series builds starting in late 2025. Its SY750E excavator prototype also features 800V ultra-fast charging.

- Zoomlion: Its ZTE210 120-tonne electric mining truck, launched in January 2024, uses an implicit ~800V AC variable-frequency traction system.

- XCMG: Its e-L4 electric loader, commercially available since late 2024, utilises a 750V system.

- CATL: A key enabler, CATL supplies 800V-ready Qilin 3.0 battery packs supporting 4C fast-charging and is expected to achieve full commercialisation of 800V systems by 2026.

Despite the clear benefits, challenges remain, including the higher cost of SiC/GaN semiconductors, complex thermal management, and the lack of standardised high-voltage charging infrastructure at remote sites.

4. Drive Control:The Integrated Electrical System

The drive control system acts as the central nervous system of an electrified OHV, orchestrating the entire e-powertrain to ensure optimal performance, efficiency, and safety. This is not a single component but rather an integrated network of specialised electronics. Key subsystems include the Vehicle Control Unit (VCU), which manages the powertrain and energy distribution; the motor inverter, which handles the direct control of the electric motor; and the Battery Management System (BMS), which monitors and protects the battery pack. Leading suppliers like Bosch, Continental, and Danfoss provide comprehensive suites of these off-highway electronics, often as integrated modules that combine vehicle control, power distribution, and safety monitoring into a single, robust architecture.

The core function of this integrated system is to precisely manage power flow across all operational scenarios. This involves sophisticated motor control algorithms that regulate speed and torque, enabling advanced capabilities like torque vectoring to improve traction and stability in challenging off-road conditions. The system also performs crucial energy optimisation, where the VCU and BMS work in tandem to monitor the battery’s state of charge (SOC) and state of health (SOH), protect the cells, and execute predictive energy management strategies that can extend vehicle range by up to 15%. Furthermore, the control system seamlessly manages regenerative braking, converting the vehicle's kinetic energy back into electrical energy during deceleration to maximise efficiency. The architectural trend is a shift from numerous distributed ECUs to more powerful, centralised zonal controllers that can handle increasing software complexity and support the integration of telematics and autonomous systems.

5. Regulatory Frameworks and Quality Assurance

To ensure safety, interoperability, and reliability, a sophisticated framework of industry standards, statutory regulations, and quality assurance regimes governs e-powertrain systems in off-highway vehicles globally.

Key Industry Standards A suite of ISO, IEC, and SAE standards provides the technical foundation for e-powertrain systems.

- EMC:ISO 13766-1/2:2018 governs electromagnetic compatibility, ensuring immunity to disturbances in construction machinery. UNECE R10 is also widely adopted for vehicle EMC type-approval.

- Battery Systems:ISO 12405 (Parts 1-4) for lithium-ion traction batteries, IEC 62660 for abuse testing, and UN 38.3 for transport safety set critical performance and safety benchmarks.

- Charging Interfaces:IEC 62196-3:2022 and IEC 61851-1 detail DC charging modes and connector specifications, supporting standards like CCS, while China uses GB/T 20234 and Japan uses CHAdeMO (evolving to ChaoJi).

- Functional Safety:ISO 26262:2018 mandates Automotive Safety Integrity Levels (ASILs) and a rigorous lifecycle process for safety-critical hardware and software. China has localised this with the GB/T 34590-series.

Regional Regulatory Requirements Type-approval processes for non-road mobile machinery (NRMM) vary by region but share common goals.

- EU and UK:Regulation (EU) 2016/1628 (Stage V) sets stringent limits on pollutants for all engine types, including hybrid and pure-electric machines. The UK maintains alignment via Statutory Instrument 2021/0210.

- China: The MEE’s China III and IV standards govern diesel emissions, while the New Energy Automobile Industry Plan (2021-2035) sets ambitious ZEV sales targets supported by subsidies and a dual-credit system.

Quality Assurance Manufacturers implement automotive-grade Quality Management Systems (QMS) certified to IATF 16949, which mandates risk-based thinking and continuous improvement. Laboratory accreditation to ISO 17025 ensures the validity and mutual recognition of test data. Functional safety audits, supported by Failure Mode and Effects Analysis (FMEA), confirm ISO 26262 compliance, while accelerated life testing (HALT/HASS) uncovers latent defects in powertrain components.

6. Conclusion and Future Outlook

The electrification of off-highway vehicles is no longer a distant prospect but a rapidly materialising reality. The sector is advancing along multiple technical pathways, with BEVs dominating compact and mid-size applications, hybrids serving as a crucial transitional technology for larger machinery, and hydrogen poised to decarbonise the heaviest-duty segments post-2030. The accelerated development of high-voltage architectures, particularly by Chinese OEMs, signals a new era of efficiency and performance for large-scale mining and construction equipment.

However, significant challenges remain. The provision of robust charging infrastructure at remote and temporary worksites is a critical hurdle that requires innovative solutions like modular charging, on-site renewables, and microgrids. Furthermore, the need for harmonised standards for high-voltage connectors, battery swapping systems, and safety protocols is paramount to ensure interoperability and drive down costs.

The industry’s “beachhead model” strategy, starting with lighter, more amenable segments like forklifts and mini-excavators to build component volumes and supply chains, is proving effective in paving the way for the electrification of heavier equipment. Ultimately, continued collaboration between OEMs, suppliers, regulatory bodies, and research institutions will be the linchpin for overcoming the remaining barriers and fully realising a safe, efficient, and sustainable future for off-highway machinery worldwide.

Back to the index